Living wages for gig workers

by - Iftikhar Ahmad & Ambreen Riaz

in an era dominated by the gig economy, where flexible employment opportunities abound, a recent World Bank report reveals that this sector constitutes a staggering 12 percent of the global labour market — a figure much higher than previously estimated.

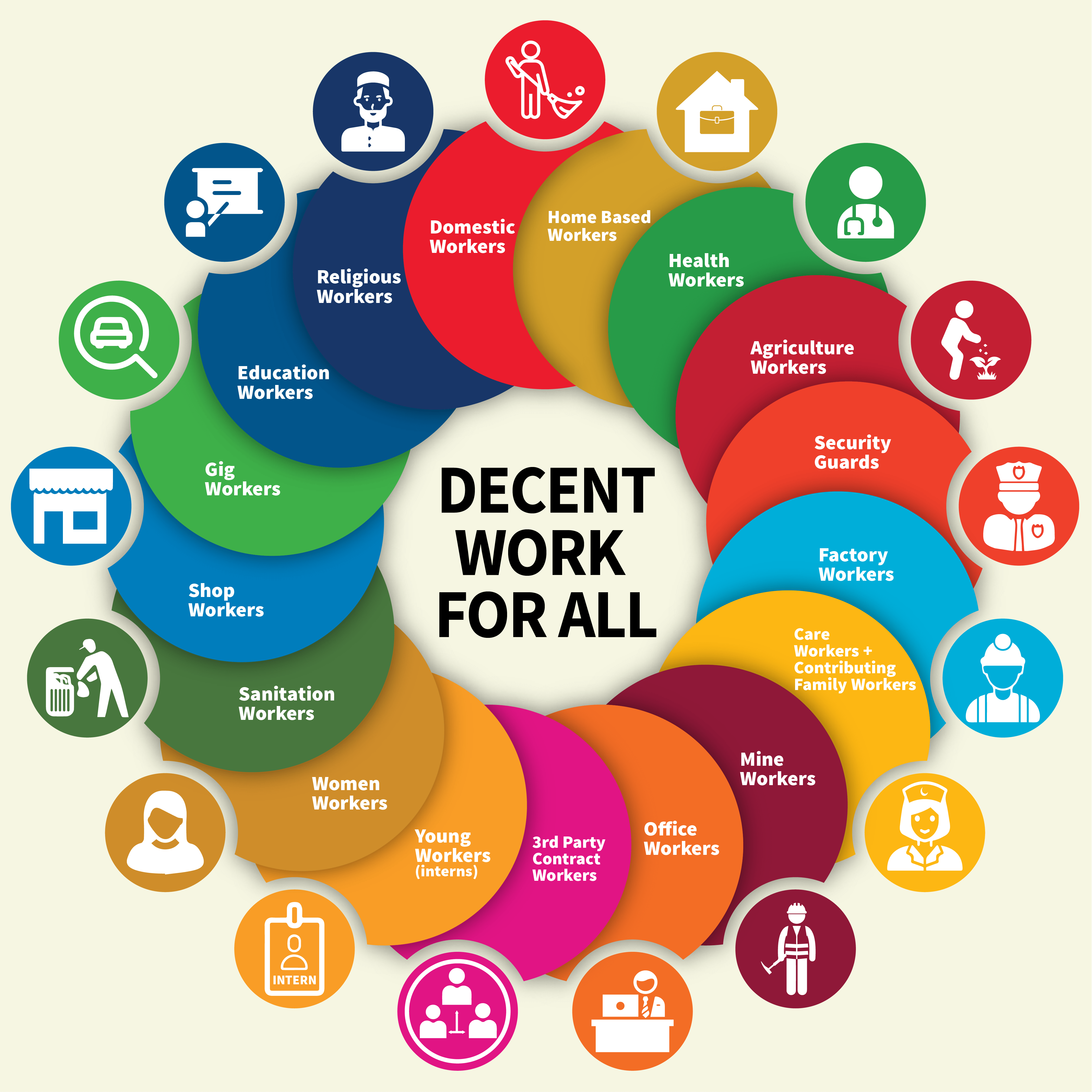

The allure of online gig work, particularly for women and youth in developing countries, is on the rise. However, a critical gap persists: social protections for workers in this burgeoning segment are sorely lacking.

Highlighting the significance of this sector for developing nations, the report underscores that low and middle-income countries contribute a substantial 40 percent of traffic to gig platforms. In Pakistan, where more than 80 percent of the workforce engages in informal jobs with limited labour law protections, the gig economy emerges as a silver lining, bridging unemployment gaps for around 2 million workers. These workers operate in diverse fields, such as micro work or freelancing services;ride-hailing; professional services; and food or grocery delivery.

Yet, the challenges faced by gig workers are manifold. One of the most pressing issues is the prevalence of low wages, exacerbating financial instability. Navigating through the intricate landscape of gig work, particularly for location-based industries, proves challenging for workers in accurately determining their wages.

The hidden and indirect costs, such as extended taxi ride waits; last-minute cancellations; and unpaid extra work, often elude proper estimation. This lack of information fosters a false sense of satisfaction with earnings, leading workers to overlook substantial costs related to fuel; waiting time; and platform commissions.

This, in turn, gives rise to negative income — a phenomenon termed as platform debt, especially prevalent among workers in ride-hailing platforms. The research done by the Centre for Labour Research together with the Fairwork Foundation, Oxford University corroborates this.

The first crucial step in this journey is to empower workers with the awareness of what constitutes a decent living wage. Equipped with this knowledge, gig workers are better positioned to advocate for their rights and demand just compensation from the platforms.

Addressing these challenges head-on, a groundbreaking initiative has emerged as a beacon of change. The Living Tariff Tool, a collaborative effort between GIZ and the Wage Indicator Foundation, is set to revolutionise the gig economy by providing workers with a powerful tool to determine their fair earnings. This web-based initiative, rooted in the concept of Living Tariff, is tailored for those offering low-skilled, low-complexity location-based and online services.

The Living Tariff Tool operates as a comprehensive solution, factoring in all associated costs that gig workers might overlook.The Living Tariff encompasses not only daily living expenses but also incorporates the often-overlooked costs of work-related resources. These include equipment expenses; overhead costs; taxes; social security; and provisions for sickness and retirement.

By considering these factors, gig workers gain a holistic view of their necessary income, ensuring they are adequately compensated for their contributions.

Users can fine-tune variables to align with their individual situations, providing a personalised and relevant experience that resonates with the unique dynamics of gig work.

This groundbreaking tool is built on four key components:

Wage Indicator’s living wage: A benchmark for a fair and just wage, rooted in extensive research on various job types, ensuring accurate and up-to-date information.

Work-related equipment cost: Accounting for the tools and resources required for gig work, this component recognises the tangible investments made by workers to execute their tasks effectively.

Overhead cost: Encompassing additional expenses incurred in the course of work, such as transportation and communication, to provide a more accurate reflection of the true cost of gig employment.

Income taxes and social security: Considering financial responsibilities towards taxes and social security, this component ensures that workers factor in all legal obligations, contributing to a more transparent compensation model.

This tool is a game-changer for gig workers navigating the intricacies of their unique employment landscape. Cognizant with the ability to accurately determine their fair wages, gig workers gain a powerful tool for negotiation. As they become more informed about the real cost of their labour, they are better poised to engage with platforms and demand remuneration that aligns with the value they bring to the digital marketplace.

The Living Tariff Tool represents a significant step towards fostering a fairer and more transparent gig economy. As workers harness the power of this web-based initiative, they not only secure their financial well-being but also contribute to reshaping the narrative around gig work. In a world where the gig economy plays an increasingly integral role, initiatives like the Living Tariff Tool mark a pivotal moment in ensuring that the workforce driving this sector receives the compensation they rightfully deserve.

Transparency takes centre stage as a cornerstone objective of the Living Tariff Tool. By illuminating the intricacies of compensation within the gig economy, the tool aims to reduce information imbalances between gig workers and employers, fostering a work environment where all stakeholders are well-informed and treated fairly.

The tool’s distinctive feature lies in its reliance on data-driven calculations, drawing from extensive research on various job types, Wage Indicator Living Wage data and legal standards. This commitment to precision not only empowers gig workers with reliable insights but also contributes to setting industry standards for fair compensation.

Beyond immediate applications, the Living Tariff Tool seeks to be a catalyst for broader discussions on gig worker rights and fair labour practices.Importantly, the tool’s flexibility stands out as a key feature, applicable to anyone performing work described in the tool, whether through an online platform or not.

Users can fine-tune variables to align with their individual situations, providing a personalised and relevant experience that resonates with the unique dynamics of gig work. Addressing compensation issues within the gig economy, it becomes a driving force in advocating for the rights and well-being of gig workers on a larger scale, contributing to ongoing dialogues on the future of work.

Beyond the realm of fair wages, this tool empowers companies to leverage insights for identifying areas where additional benefits, such as healthcare, insurance, or retirement plans, can be tailored to meet the specific needs of the gig workforce. This holistic approach not only aligns with the Living Tariff Tool’s primary objective but also fuels discussions on improving working conditions of gig workers within the dynamic landscape of the gig economy.

This was published on TNS on 18 February 2024